Kathryn Cicoletti on Inflation and Interest Rates

August 28, 2022

The majority of this was in our LP letter. I added several things that are not LP letter appropriate and more blog appropriate. Another thing I want to clarify is I’m writing this as if I was paying attention to interest rates and inflation in the 70s and 80s. I wasn’t. My opinions are based on being born in 1977. My mom continues to remind me that around the time I was born, 30-year mortgage rates were over 10%, the Fed Funds rate was 20%, and inflation was around 12%. Today the 30-year mortgage is around 6%, the Fed Funds rate is 2.25%, and inflation is 8.5%. I understand her point. I don’t argue with Boomers on inflation and interest rate trauma.

I am happy that Fed Chairman Powell finally admitted on Friday that households and businesses need to buckle up for a ride. Chairman Powell clarifying that we should in fact expect to see pain as a result of interest rate increases is really the perfect end to the summer. We’ve spent boat loads of money on travel, used all our vacation days, caught COVID, and we’re now confined (again) to ordering groceries from Instacart despite how many times the driver cancels the order because they got a better job. We’ve all been in pain the last three years and now we have more pain ahead? I would like to speak to pain’s manager. We don’t need more pain.

The yield on the two-year treasury has been higher than the 10-year yield indicating an inverted yield curve and a recession.

U.S. GDP declined by ‑0.9% in Q2 after declining ‑1.6% in Q1 indicating we are in a recession despite clarity from the NBER.

Major stock indices are down ~15% for the year through August and high-grade bond indices have lost ~10% YTD.

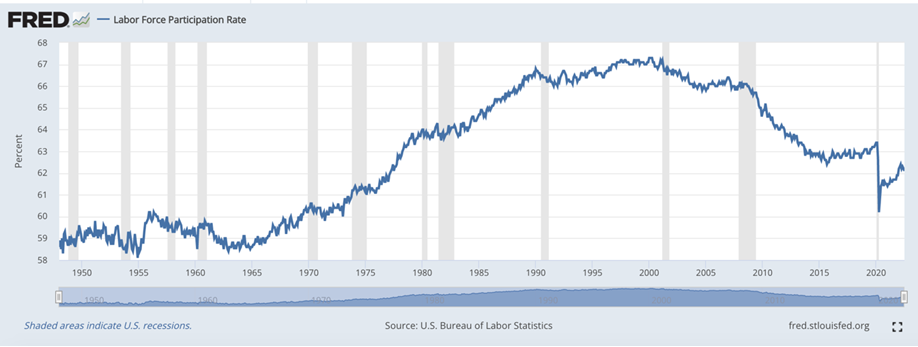

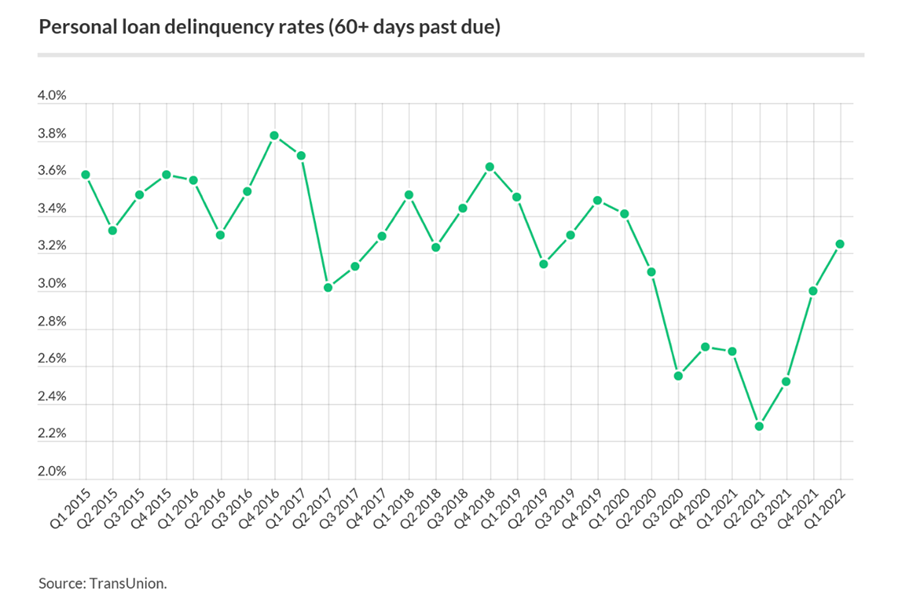

To add to the conundrum, prices we pay for goods and services are skyrocketing, the consumer continues to spend, yet economic growth is declining, the labor participation rate is at its lowest level in decades, and personal loan delinquencies are spiking!

Powell just signaled the will Fed continue to increase interest rates to tame inflation, even if the economy, public markets, and private markets are at stake in the short-term.

The good news is these conflicting data points are not unfamiliar to the Fed. The bad news is prior medicine involved wrangling inflation through aggressive interest rate increases, even if it choked the economy, which ultimately led to a decrease in short-term rates to re-stimulate the economy and get back to equilibrium. Read any article that came out on Friday after Powell spoke in Jackson Hole and you’ll see we’re in for a similar roller coaster ride over the next few years. This puts both public and private markets in a very delicate situation.

Now on to some inputs….

Grain and wheat prices have subsided, freight costs are varied (vs. perpetually spiking), and fertilizer prices, while still high, are on the decline. Ukraine recently exported its first crop shipment following Russia’s invasion. As one of the world’s largest grain exporters, the increase in supply helped push both corn and wheat prices down ~35% from their highs and back to their pre-war levels.

Shipping costs have created a bigger challenge for companies as transpacific freight costs are varied at best and still significantly elevated at worst. The slower US economy helped reduce spot rates for 20-foot containers to the US from Asia by about 33% through mid-June since peaking last September. However, some trade lanes still cost more than 5X their five-year average before the pandemic. One of the main goals of the recent Ocean Shipping Reform Act is to alleviate supply-chain bottlenecks and relieve elevated container costs. In the end, American importers and exporters felt the law fell short on price controls and still leaves them beholden to a consortium of overseas shipping giants that control the majority of capacity that moves trade globally. While there has been some relief in food-related commodity prices and region-specific shipping costs, supply-chain disruptions, skyrocketing ingredient costs, rising interest rates, and a decline in GDP continue to create a very challenging macro scenario for all companies.

What about exits? I bought the domain backthatspac.live in 2020. I’m still trying to get my twenty bucks back from Squarespace. Exits have tanked as profitability continues to be a top priority for any acquisition, merger, or IPO. IPOs are down ~90% y‑o-y for the first half of the year leading CEOs (Jamie Dimon) of the largest global financial institutions to tell investors that an economic “hurricane” is on the way. Consumer-focused companies have been facing their own DTC hurricane as stay-at-home retail wanes off COVID highs and CACs spike. Companies are re-forecasting budgets for a new CAC normal and a partial shift back to in-store retail. This is a trend nearly all DTC private companies are adjusting for as “stay inside” stocks like Shopify, Peloton, and Zoom have been experiencing earnings pressure all year. The Fed will continue to exacerbate the situation as higher rates reduce valuations of high growth companies, which causes them to reduce spend, which can result in a slowing economy. Most companies are focused on preserving cash, cutting expenses, and building their foundation for profitability in 2023 and beyond.

Fighting inflation is the Fed’s number one priority. How high will they go before they start dropping rates again? I heard on the All in Pod that the number is 5%. That’s 2x where we are now.

Find Kathryn on Substack, and Twitter.