How Clean Labels Are Transforming Our Food System

March 11, 2024

When Jeremy Adams made a 2:00 a.m. store trip, he was faced with a dilemma.

He needed an oral electrolyte for his young daughter, but he was thrown off by the ingredients. The product was full of artificial dyes: Yellow #6, Blue #1, and Red #40. He didn’t even want to drink it himself, let alone give it to his daughter.

Taking matters into his own hands, Adams, the CEO of Kinderfarms, developed Kinderlyte as an alternative to artificially colored oral electrolyte solutions. While Kinderlyte stands out as one of the only natural electrolyte solutions of its kind, Adams’ grocery store encounter is a common story. A growing number of consumers are aware of the vibrant dyes that color their foods.

This is the story of how artificial dyes entered the foods we eat, some health concerns they raise, and the emerging market for healthier alternatives and clean label foods.

How artificial dyes invaded shelves

Stacks of vibrantly colored products line the food aisles in American stores. That’s no accident, but their invention was. In 1856 when a scientist named William Henry Perkin was trying to synthesize quinine from coal-tar derivatives, he stumbled on a vibrant purple powder when he heated the coal. This patent established him as a dye businessman.

These colors, which were initially used to dye textiles, were soon adopted by the food industry to develop eye-catching products. Since then, they have been used in everything from candies and confectioneries to jellies and ice creams.

While ubiquitous, these artificial dyes can be problematic – and the search for a replacement is leading to innovation in several industries.

Food dye allergy findings and the FDA response

Customers – especially children – eat with their eyes first, so it’s not surprising that these vibrant colors became a staple on grocery store shelves. From Skittles to Kool-Aid, prominent products aimed at catching the attention of consumers contain artificial colors and flavoring agents to appeal to wider audiences.

With the backdrop of COVID-19 and heightened awareness in the years since – consumers have become more curious about the ingredients listed on their favorite products. Inspiring a wave of more health-conscious shoppers, the pandemic prompted consumers to ask these questions:

- What do these ingredients consist of?

- What levels of these artificial dyes are safe to consume?

- Are there any health concerns associated with them?

The answers started emerging as early as 1970 when allergists proposed that these dyes might induce hyperactivity and behavioral changes in children who were highly sensitive to even small doses. Over the next 50 years, several independent studies, double-blind trials, and meta-analyses have shown a link between artificial dyes and hyperactivity symptoms (now termed ADHD).

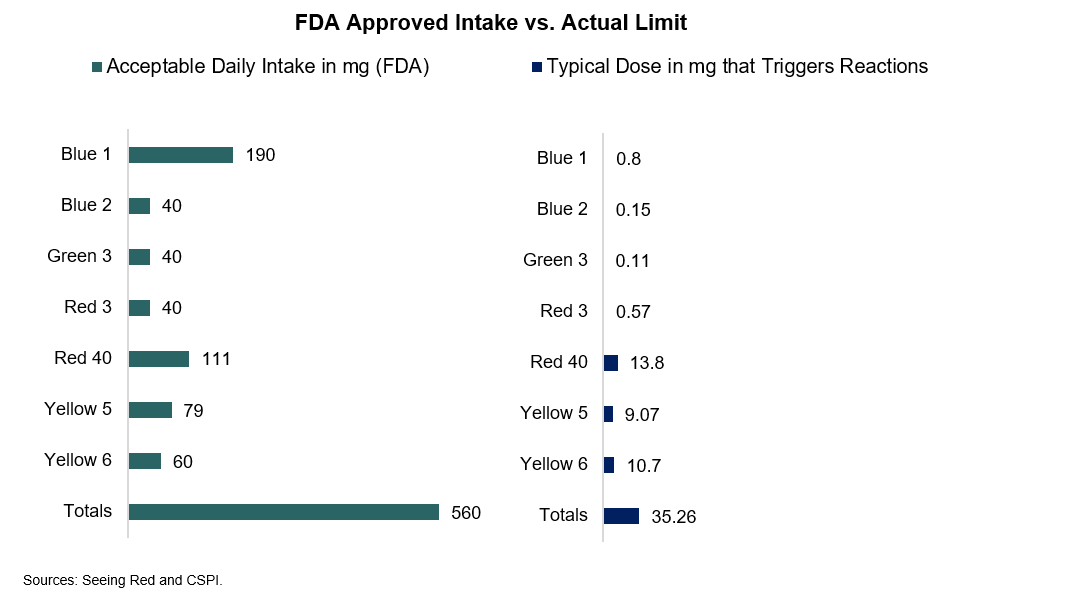

In response, the FDA conducted studies that cleared seven artificial dyes for food production, including Blue #1, Blue #2, Green #3, Red #3, Red #40, Yellow #5, and Yellow #6. Commonly found in candies, baked goods, and soda, these dyes – just like their vessels – were found by the FDA to be safest in moderation.

While FDA efforts to identify acceptable consumption levels continue, the Center for Science in the Public Interest (CSPI) uncovered more specific measurements detailed in the chart below.

Not only are natural ingredients becoming more prominent, but government agencies are beginning to shift toward healthy alternatives and prioritizing transparency on their labels.

Modifications around the globe

Increased access to information about the ingredients on high-demand food labels has fed into legislative action over the last few decades, reaching a fever pitch in recent years.

Across the pond, European countries took a precautionary approach with food additives, even when the evidence wasn’t completely conclusive. Based on two government studies conducted in 2004 and 2007, the FSA and EFSA (the U.K. and European counterparts of the FDA) passed laws mandating companies to display a clear warning that food coloring might have “an adverse effect on the activity and attention of children.”

U.S.-based multinational companies had to follow suit in producing dye-free versions of their products for European markets, and some U.S. states are taking it a step further.

California banned food additives in Assembly Bill 418 (AB 418), known as The California Food and Safety Act, which will take effect in 2027. Legislation is also being discussed in New York that seeks to ban similar food additives to those banned in California, citing health concerns ranging from hormonal imbalance to behavioral problems.

Unlike The California Food and Safety Act, New York’s ban on food additives would take effect immediately, applying pressure on food manufacturers to swap synthetic additives for natural alternatives.

Innovating natural solutions

While punitive action is one way to increase nutritional transparency on food labels, calls from customers for standardized “clean labels” are getting louder.

Consumers prioritizing clean label foods are shaping the food industry. They are conscious about what goes into what they eat, prefer natural and healthy ingredients, and avoid artificial additives and colors.

What will that look like in the marketplace? For starters, grass-fed meat, organic ingredients, and natural food colors – like spirulina and carotenoids – will be at the forefront of product development.

According to Future Market Insights, the market for natural food colors is estimated to be around $1.7 billion and projected to grow to $3.3 billion in 2033. Spirulina-based colors and Carotenoids are currently the market’s largest segment, with over 40% of all natural food color sales being spirulina.

The ease with which these dyes will be adopted by the industry is based on several factors:

- How easy is it to reformulate the product with the new dye?

- What advantage does it give in regulatory compliance?

- How does it affect the supply chain?

- Is it cost-efficient?

- Can it be marketed to cater to a customized audience?

The last factor here might hold the key to accelerating adoption.

The clean label initiative

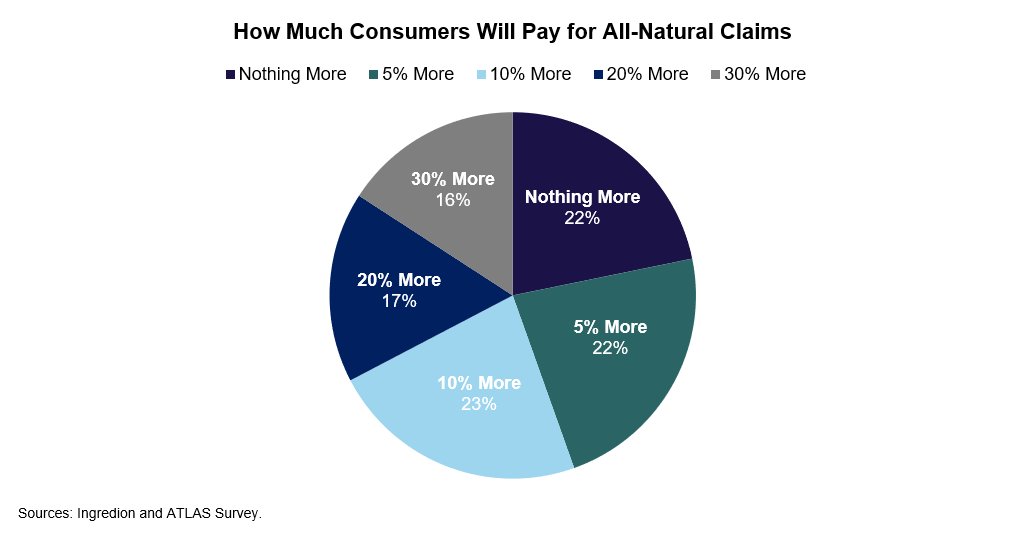

Natural food colors aren’t just a “good-to-have.” According to Ingredion’s ATLAS study, 33% of customers are willing to pay up to 20% more for products that make all-natural claims, and “all-natural” and “no artificial ingredients” were among the top claims that customers were willing to pay more for.

In addition, 44% of consumers surveyed in 2023 reported checking ingredient and nutrition labels when selecting products, up from 35% in 2020. Preferential shifts from products that once dominated the consumer market to food and beverages with clear labels and clean ingredients are also on the rise.

More consumers now are opting for grass-fed beef, naturally sweetened coffee creamers, and prebiotic drinks over plant-based meat, oat-based creamers, and old-fashioned sodas. Beyond what goes into popular products, emphasis is placed on what the products are packaged in.

Liquid Death, a GroundForce Growth I beverage and lifestyle company, is putting “death to plastic” with its eco-friendly cans encapsulating a drive toward non-plastic packaging. While their viral 2022 Super Bowl ad famously featured kids “breaking the law” by chugging mountain water, Liquid Death’s popularity can be attributed to how they are breaking the mold of traditional containers.

The theme? Consumers have heightened concerns about the contents of food products, how they impact their health, and how they are packaged. As awareness increases, innovation in the CPG food space is bound to spike, as evidenced by the founding story of KinderFarms.

With evolving regulations, shifts in consumer preferences, and a movement toward clean labels, the outlook is auspicious for companies in the CPG industry.